Navigating the exciting, often volatile world of cryptocurrency can feel overwhelming, especially when the conversation extends beyond Bitcoin. While Bitcoin remains the digital gold standard, altcoins – alternative cryptocurrencies – offer a diverse landscape of innovation, investment opportunities, and potential risks. This guide will delve into the world of altcoins, exploring their purpose, potential, and how to approach them intelligently.

What are Altcoins?

Defining Altcoins

Altcoins, short for “alternative cryptocurrencies,” are any cryptocurrencies other than Bitcoin. Launched after Bitcoin’s success, they aim to improve upon or offer unique features not found in Bitcoin. This includes different consensus mechanisms, faster transaction speeds, increased privacy, or specific use cases within various industries.

For more details, see Investopedia on Cryptocurrency.

Types of Altcoins

Altcoins can be categorized based on their underlying technology and purpose. Understanding these categories can help in assessing their potential and risks:

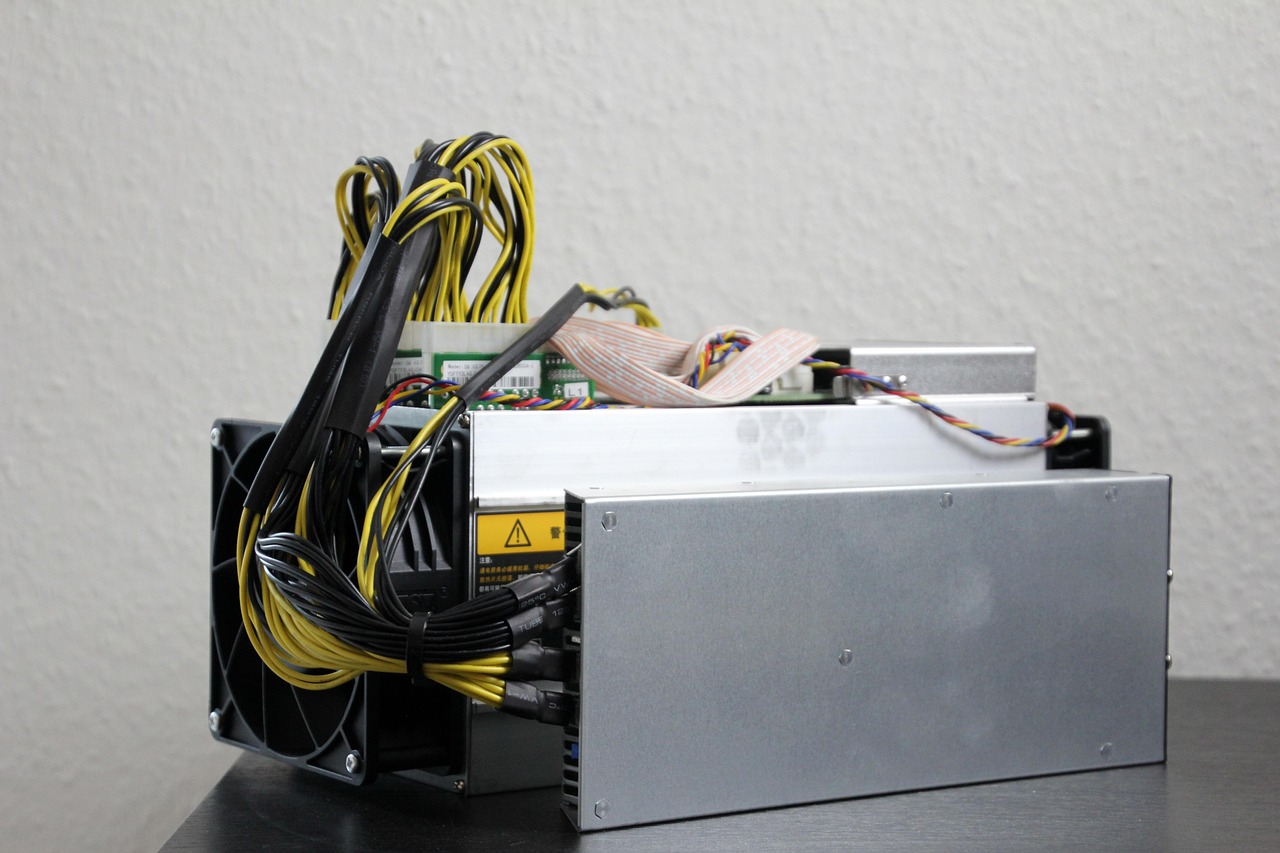

- Mining-Based Altcoins: These coins use a Proof-of-Work (PoW) consensus mechanism, similar to Bitcoin, requiring miners to solve complex cryptographic puzzles to validate transactions and earn rewards. Litecoin and Monero are examples.

- Staking-Based Altcoins: These coins utilize a Proof-of-Stake (PoS) consensus mechanism, where users stake their coins to validate transactions and earn rewards. Cardano and Solana fall into this category. Staking is often considered more energy-efficient than mining.

- Stablecoins: Designed to maintain a stable value, usually pegged to a fiat currency like the US dollar. Tether (USDT) and USD Coin (USDC) are prime examples. They aim to provide stability within the crypto market and facilitate trading.

- Governance Tokens: These tokens give holders voting rights within a specific blockchain project, allowing them to participate in decisions regarding the future of the project. Examples include Maker (MKR) and Compound (COMP).

- Meme Coins: Cryptocurrency based on a meme or joke. These coins are usually very volatile and speculative. Dogecoin (DOGE) and Shiba Inu (SHIB) are examples.

- DeFi Tokens: Cryptocurrency used in decentralized finance applications, for example, on decentralized exchanges, lending, or borrowing protocols. Examples include Uniswap (UNI), Aave (AAVE).

Why Altcoins Exist

Altcoins exist for several reasons, primarily to address perceived shortcomings in Bitcoin or to introduce new functionalities. Here are some key motivations:

- Improved Transaction Speed: Some altcoins offer faster transaction times than Bitcoin, making them more suitable for everyday transactions. Litecoin, for instance, boasts faster block times.

- Enhanced Privacy: Coins like Monero prioritize anonymity, making transactions harder to trace. This appeals to users seeking greater financial privacy.

- Smart Contract Functionality: Ethereum introduced smart contracts, enabling the creation of decentralized applications (dApps) and revolutionizing the potential uses of blockchain technology.

- New Use Cases: Altcoins can be designed for specific purposes, such as supply chain management, identity verification, or content creation.

Benefits and Risks of Investing in Altcoins

Potential Benefits

Investing in altcoins can be potentially rewarding, but it’s essential to understand the associated risks.

- High Growth Potential: Some altcoins have experienced significant price increases, offering early investors substantial returns. This potential for high growth attracts many to the altcoin market.

- Diversification: Altcoins can diversify a cryptocurrency portfolio, potentially reducing overall risk by spreading investments across different assets.

- Innovation: Investing in altcoins can support innovative blockchain projects and technologies with the potential to disrupt existing industries.

Inherent Risks

The altcoin market is known for its volatility and speculative nature.

- High Volatility: Altcoins are often more volatile than Bitcoin, meaning their prices can fluctuate dramatically in short periods.

- Lower Liquidity: Many altcoins have lower trading volumes and liquidity than Bitcoin, making it harder to buy or sell large amounts without affecting the price.

- Scams and Fraud: The altcoin market is prone to scams and fraudulent projects, making thorough research essential before investing.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and regulatory changes could negatively impact the value of certain altcoins.

- Technological Risks: Some altcoins might be based on unproven or flawed technologies, increasing the risk of project failure.

Researching Altcoins: A Due Diligence Checklist

Understanding the Technology

Before investing in any altcoin, it’s crucial to understand the underlying technology:

- Whitepaper Analysis: Read the whitepaper to understand the project’s goals, technology, and roadmap.

- Consensus Mechanism: Research the consensus mechanism (PoW, PoS, etc.) and its implications for security and efficiency.

- Code Audit: Check if the project’s code has been audited by a reputable third-party firm to identify potential vulnerabilities.

- Team and Developers: Research the team behind the project and their experience and expertise. Look for transparency and a proven track record.

Assessing the Market

Evaluate the altcoin’s market potential and competitive landscape:

- Market Capitalization: Analyze the market capitalization of the altcoin. A higher market cap typically indicates more stability but lower growth potential.

- Trading Volume: Check the trading volume to ensure sufficient liquidity. Higher trading volume usually indicates greater interest and easier entry and exit.

- Competition: Identify competing projects and evaluate the altcoin’s competitive advantages.

- Community Support: Assess the size and engagement of the project’s community. A strong community can be a positive indicator of long-term viability.

Practical Example: Researching Cardano (ADA)

Let’s consider an example: Cardano (ADA). To research Cardano:

- Whitepaper: Read the Cardano whitepapers to understand its academic approach to blockchain development and its Proof-of-Stake (PoS) consensus mechanism, Ouroboros.

- Team: Research IOHK, the company behind Cardano, and its founder, Charles Hoskinson.

- Technology: Investigate Cardano’s layered architecture and its focus on scalability and sustainability.

- Market: Analyze Cardano’s market capitalization and trading volume on major exchanges.

Performing similar research for any altcoin you consider is critical for making informed investment decisions.

Safely Buying and Storing Altcoins

Choosing a Cryptocurrency Exchange

Selecting a reputable cryptocurrency exchange is vital for buying altcoins safely:

- Reputation: Choose well-known and established exchanges with a good reputation in the crypto community. Examples include Coinbase, Binance, and Kraken.

- Security Measures: Look for exchanges with robust security measures, such as two-factor authentication (2FA), cold storage of funds, and insurance against hacking.

- Supported Altcoins: Ensure the exchange supports the altcoins you want to buy.

- Fees: Compare the trading fees and withdrawal fees charged by different exchanges.

- Regulatory Compliance: Check if the exchange complies with relevant regulations in your jurisdiction.

Storing Your Altcoins

After buying altcoins, secure them in a wallet you control:

- Hardware Wallets: These are physical devices that store your private keys offline, providing the highest level of security. Ledger and Trezor are popular brands.

- Software Wallets: These are applications installed on your computer or smartphone. They are more convenient but less secure than hardware wallets. Examples include Electrum and Exodus.

- Exchange Wallets: Storing your altcoins on an exchange wallet is generally not recommended for long-term storage due to security risks.

Best Practices for Security

Follow these best practices to protect your altcoin investments:

- Enable 2FA: Enable two-factor authentication on all your exchange and wallet accounts.

- Use Strong Passwords: Use strong, unique passwords for each account.

- Keep Your Software Updated: Keep your operating system, wallet software, and exchange apps updated to patch security vulnerabilities.

- Be Wary of Phishing: Be cautious of phishing attempts and never share your private keys or seed phrases with anyone.

- Backup Your Wallet: Regularly back up your wallet to ensure you can recover your funds if your device is lost or damaged.

The Future of Altcoins

Emerging Trends

The altcoin market is constantly evolving, with new trends and technologies emerging:

- Decentralized Finance (DeFi): DeFi projects aim to create decentralized financial services, such as lending, borrowing, and trading. DeFi tokens continue to gain traction.

- Non-Fungible Tokens (NFTs): NFTs represent unique digital assets, such as artwork, collectibles, and virtual real estate. They have revolutionized the art and gaming industries.

- Web3: Web3 aims to create a decentralized internet based on blockchain technology. Altcoins play a crucial role in powering Web3 applications.

- Layer-2 Scaling Solutions: Layer-2 solutions aim to improve the scalability of blockchain networks, enabling faster and cheaper transactions.

Potential Impact on Industries

Altcoins have the potential to disrupt various industries:

- Finance: DeFi altcoins can revolutionize traditional financial services by offering decentralized lending, borrowing, and trading platforms.

- Supply Chain: Altcoins can enhance supply chain transparency and traceability by tracking goods and materials on a blockchain.

- Gaming: Gaming altcoins can create new revenue streams for gamers and developers through play-to-earn models and in-game asset ownership.

- Healthcare: Altcoins can improve data security and interoperability in the healthcare industry by enabling secure and decentralized sharing of patient records.

A Word of Caution

While the future of altcoins looks promising, it’s crucial to remain cautious and informed:

- Do Your Own Research (DYOR): Always conduct thorough research before investing in any altcoin.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your cryptocurrency portfolio to mitigate risk.

- Manage Your Risk: Only invest what you can afford to lose.

- Stay Informed: Keep up with the latest news and developments in the cryptocurrency market.

Conclusion

Navigating the world of altcoins requires a blend of curiosity, careful research, and a healthy dose of skepticism. While the potential for significant returns is undeniable, so are the inherent risks. By understanding the different types of altcoins, conducting thorough due diligence, and prioritizing security, you can approach the altcoin market with greater confidence and make informed investment decisions. Remember that responsible investing involves understanding both the potential upside and the potential downside of any investment, and altcoins are no exception. The future of altcoins is uncertain, but one thing is clear: they are here to stay and will continue to shape the evolution of the cryptocurrency landscape.

Read our previous post: Quantum Leaps: Rewriting Reality With Generative AI